Ides Of March 2016 – Et Tu, Puerto Rico?

IDES OF MARCH 2016 – ET TU, PUERTO RICO?

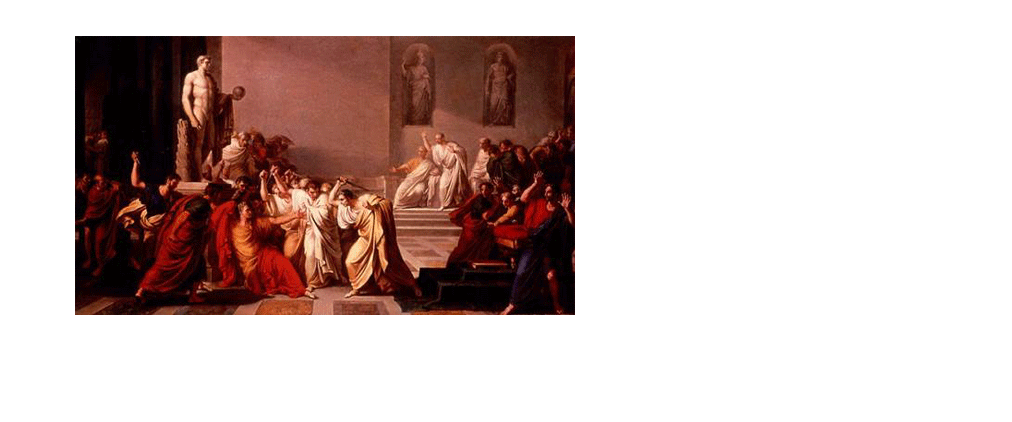

The Ides of March, the 15th of the month, represents the monthly midpoint of the Roman calendar. Julius Caesar was assassinated on the Ides in 44 BC by his friend Marcus Brutus and others. As he lay dying, Caesar uttered these words to his friend, “Et Tu, Brute?” (You, too, Brutus).

Caesar’s assassination transformed Roman history – it was the central event in marking the transition from the Roman Republic to the Roman Empire.

Which brings me to today’s topic – Puerto Rico’s financial state and the repercussions for the municipal market.

The financial chaos unfolding in the island paradise, El Borinquen, may prove to be transformative for bond investors’ psyche – just as Caesar’s demise changed the arc of Roman history.

Here is our premise: if Puerto Rico attempts and succeeds in treating the interests of General Obligation bond investors in a cavalier fashion similar to the way Detroit succeeded, the repercussions for average and below average quality municipal issuers will be negatively impacted. Some in this group will lose access to public capital markets, while others will have access at an inflated cost that is paid by local tax and rate payers.

Issuers in these groups (Chicago Public Schools, for a recent example) are typically more dependent on the capital markets than stellar credits. Liquidity is often an issue and the bond market provides the liquidity they seek. Generally speaking, Detroit’s treatment of general obligation bonds has created doubt in the minds of investors. Many are closely watching how Puerto Rico acts.

Continuing with our Caesarean analogy, we wonder if Puerto Rico and the municipal market are at the banks of the Rubicon and ask, Et Tu, Puerto Rico?

In the following pages we discuss:

- Puerto Rico

- Detroit’s reality post Chapter 9

- A Congressional role in Puerto Rico

- Ideas to improve investor confidence

- Strength of the municipal market

PUERTO RICO IS NOT DETROIT

Detroit’s court approved plan is not a template for a solution to Puerto Rico’s problems because:

- Puerto Rico cannot file for bankruptcy; some have asked Congress to grant it this power. Congressional sentiment on the issue is divided.

- Puerto Rico’s problems are different; debt structure, security pledges, pension issues are not the same.

- Some in the island’s leadership have stated they want to honor payments to general obligation and revenue bond investors and that a debt repayment waterfall structure is needed. Detroit’s position was the polar opposite and problems persist post-bankruptcy because the unfunded pension issue was not resolved. (i)These comments are thoughtful and a good starting point, acknowledging the devil lies in the complicated details. Puerto Rico needs affordable investor capital (absent a federal bailout) to help it successfully emerge from its crisis.

A DIRECTION of ORDER is IN ORDER

All stakeholders must come to the table in order to enact an orderly restructuring.

The problems for the island exist both due to its cost-structure and level of financial liabilities. Therefore, every constituency, debtor and creditor, will need to make concessions in some form. Giving Puerto Rico broad, unilateral powers through bankruptcy, without any oversight to write down its debt, while favoring public pensions, would be a mistake. In the long run, this approach will harm its citizens, its investors and the broader market.

Clarity and guidance on certain issues is needed and it seems to us that Congress is the body to provide it. Its leadership will better ensure an orderly and sensible re-structuring plan for Puerto Rico.

Why should Congress get involved?

- Chapter 9 law, to a great degree is being written now. Legal precedent is scant. Bankruptcy judges in Stockton, Detroit and San Bernardino have been reluctant to interject their legal solutions.

A federal judge’s power in Chapter 9, while significant is limited to making narrow determinations. The judge cannot order a municipality to raise taxes, as an example. Judges Klein (Stockton) and Rhodes (Detroit) avoided altering the debtors’ plan. Judge Rhodes offered guidance by stating Constitutional protections did NOT protect pensioners’ contractual rights in bankruptcy, but chose not to alter Detroit’s plan that clearly protected pensions over general obligation bond creditors. If judges in future Chapter 9 cases fail to add legal clarity to the process – outcomes for investors will not be good.

Congress can clarify a great deal by establishing statutory precedent in Puerto Rico’s situation. Its statutory methodology could serve as a template for other distressed situations.

2. There is no uniformity in Chapter 9, so generalizing about solutions is difficult. There are 50 states with different laws. There is no Uniform Commercial Code in the municipal space. This was problematic in Detroit, San Bernardino, and Stockton because the debtor (distressed municipality) unilaterally files its re-organization plan, which drives the mediation process. If the judge takes a hands-off approach, it is up to a creditor group to negotiate the best deal it can. There is no transparency in these mediations, unlike in a courtroom. The entire process is opaque so it is difficult to tell why creditors settled for what they got. Once a deal gets cut in mediation, it is done. It will not be re-cut because another creditor class objects to it.

This lack of clarity and lack of creditor priority is not good for debtors or creditors. Investors that have been jilted by the process will invest their capital elsewhere.

A FEW IDEAS TO GUIDE THE PROCESS

- Make it clear that Special Revenue bonds are inviolate. Detroit initially attempted to cram down losses on this investor group. It backtracked when confronted with litigation, most likely because it knew its position was illegal. The issue, however, was not decided in court. A clear statement on this topic would be helpful.

- Provide guidance regarding “classification” and “unfair discrimination” rules. These are two areas where judges possess significant power in the bankruptcy process. People are uncomfortable being classified as an unsecured creditor because of the lack of protection for this class in the Bankruptcy Code. Stockton placed investor Franklin Funds in the unsecured class, while refusing to do anything to its pensions – it called the shots. The Judge chose not to reverse this unilateral action. Franklin took an approximate 90% haircut in the final settlement. The weakening of “unfair discrimination” rules in the Detroit case is vexing to many. Chapter 9 allows for similar credit classes to be treated differently if there is no unfair discrimination. Judge Rhodes stated it is the judge’s sole discretion to decide this issue provided the disparate treatment does not violate “the moral conscience of the court”. We are unsure of what that means, but we are certain on two points:

-

- The standard is totally subjective.

- The standard is dangerous and makes investors very nervous; as a result, investment capital becomes more expensive for certain issuers.

3. A sensible, defined “waterfall payment” structure for creditors is needed. Creditors in one class should not be threatened with a similar, low recovery when their interests would receive a greater recovery in a hypothetical liquidation. As examples, voter approved, full faith and credit general obligation bond investors have a specific “millage” securing the interest. As long as the tax is collected, why should a bankruptcy plan threaten this class with a haircut so that these monies can be used for other purposes? Going further, general obligation bond investors with a security interest in general fund monies but lacking a specific tax levy may enjoy significant protection but it is diminished compared to the first group. General obligation debt is not monolithic and a debtor’s plan should recognize this fact.

4. Make clear restricted funds and intercept structures are immune from Chapter 9 machinations. Restricted funds should be viewed the same as special revenue and are not the municipality’s property. Similarly, when a municipality agrees to an intercept, its intent is to provide special protection to investors; decisions are made because this mechanism is in place. Both issues remain unsettled.

BERNARDI’S APPROACH – NOT WAITING for GODOT

We have spent many hours studying, discussing and developing a practical approach to these issues. We focus our efforts on a sensible application of our strategy to deal with reality. We and our investor clients do not have the luxury of time waiting for a federal judge or Congress to clarify or solve these issues – acting that way is the bond market’s version of “Waiting for Godot”.

Municipal bankruptcies remain incredibly rare occurrences. Municipal defaults recently have averaged less than 0.04% annually. They usually can be anticipated by periodic, thorough credit analysis. Historically, corporate bonds default at a much higher percentage.

Generally, we remain bullish on municipal bond credit quality because the vast majority of bonds are solid credits. The fact that the market today is more complicated and volatile compared to the past, underscores the importance of our municipal bond market expertise and our belief that sound portfolio management begins with thorough credit research.

We remain steadfast in our focus on the Three Pillars of Municipal bond credit research:

- Underlying credit quality

- Deal purpose

- Deal structure

When we decide a credit is weak in one pillar, we look for strength in the other two. We use different interactive strategies surrounding the three pillars to guide us so that collectively they result in sound credit quality for a particular credit. Our strategies in this area are evolving in response to current events and those we anticipate.

We believe it is difficult to have a “safe” credit in a distressed situation. Our goal is to avoid entirely, suspect credits, but credit quality changes over time. This is a reality of investing.

We do our best to address this dynamic by adhering to our time tested municipal bond credit research process and adjusting it as changing times demand. This is a major component of the value we bring to a client relationship.

After all, if a credit possesses and maintains solid underlying credit quality, essential deal purpose and solid deal structure then the Chapter 9 discussion is moot.

Thank you for your continued confidence in our team. We welcome your comments and inquiries.

Sincerely,

Ronald P. Bernardi

President and CEO

March 16, 2016

(i) Recently Detroit’s mayor, a mere 14 months after emerging from Chapter 9, stated the biggest fiscal threat facing the city is its pension fund deficit – $490 million which must be closed by 2024 as part of the “Grand Bargain” legislation. This legislation drove its bankruptcy plan and ostensibly, solved its financial problems. The approved plan requires the city to contribute $111 million in 2024. The Mayor, in his State of the City speech last month, said the required amount due in 2024 has grown to $194 million.