Oakley Union Elementary School District

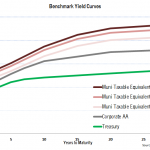

General Obligation Bonds, Election of 2016, Series 2017A

The Bonds were upgraded to AA- from A+ by S&P in coincident with the issuance. The Bonds were issued to finance a capital improvement project, and are payable from unlimited ad valorem property taxes levied and collected by Contra Costa County. The project includes financing the acquisition and construction of educational facilities, adding classrooms to prevent overcrowding, and providing classroom instructional technology. In accordance with section 53515(a) of the California Government Code, the Bonds shall be secured by a statutory lien on all revenues received pursuant to the levy and collection of the tax for general obligation bonds issued under the 2016 Authorization. The lien shall automatically attach without further action or authorization by the District or the County.*

The District is located in the City of Oakley in Contra Costa County, northeast of San Francisco. Enrollment has seen growth of 8% since Fiscal Year (FY) 2011, totaling 5,015 students. Since FY2011 assessed valuation has grown 48% to just over $3.5 billion in FY2016, equating to $85,127 per capita. The District tax base is diverse with the top 10 taxpayers accounting for 4.87% of FY2016 assessed valuation. The City of Oakley’s wealth indices far outpace both the state and national averages, with median household effective buying income at 120% and 139% respectively in 2016.

As of 8/23/2017, direct debt of the District (including the 2017A issuance) totals $41.3 million, 1.1% of FY2016 assessed valuation. The Districts unfunded OPEB liability totaled $6.04 million as of 9/1/2015. The District participates in both the CalSTRS and CalPERS pension systems. As of 6/30/2016, the District’s net pension liability for CalSTRS was $30.2 million (77% funded), while the District’s net pension liability for CalPERS was $7.7 million (83% funded).

The District’s finances likewise appear solid. The District’s 6/30/2016 balance sheet reports a General Fund Cash balance of $12.9m, or 28% of General Fund expenditures. The District’s 6/30/2016 General Fund balance of $13.3m is a robust 28% of General Fund revenues. Under the provisions of the state’s Assembly Bill 1200, each school district is required to file interim certifications with the county office of education as to its ability to meet its financial obligations for the remainder of the then-current fiscal year and, based on current forecasts, for the subsequent two fiscal years. The county office of education reviews the certification and issues either a positive, negative or qualified certification. A positive certification is assigned to any school district that will meet its financial obligations for the current fiscal year and subsequent two fiscal years. The District’s 2nd Interim Report for fiscal year 2016-17 was adopted on 3/15/17 and certified as “Positive.” The District has not received a qualified or negative certification in any of the last five years.**

*See pg. 4 of the OS

**See Appendix B, pg. 4 of the OS