Perspective for Advisors: Muni Duration & Sharpe Ratio Analysis

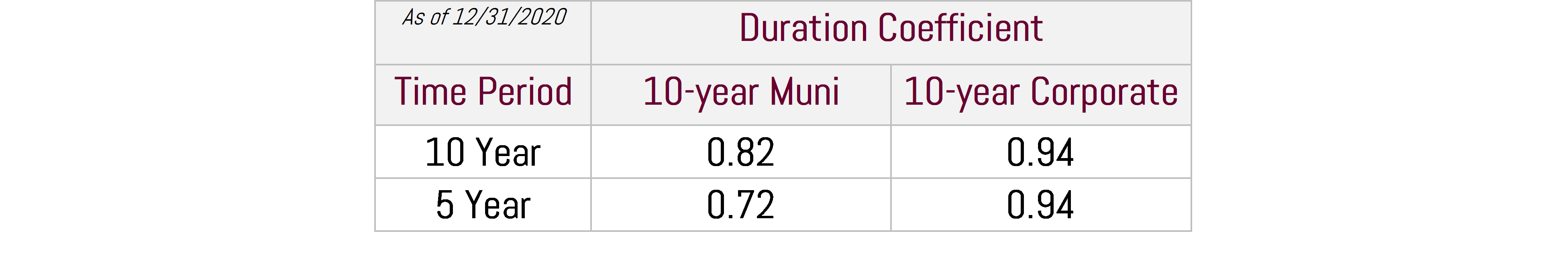

Municipal bonds are known for their credit preservation characteristics (and certainly have proved their worth during today’s crisis), but another less known attribute of the asset class is their ability to mitigate duration.1 Duration is one of the primary measures of risk for a bond portfolio and certainly a focal point for today’s portfolio managers. According to our regression analysis, over the past 10 years (as of 12/31/2020), the correlation between tax-exempt municipals and taxable treasuries was high at roughly 88%, but municipals displayed lower volatility. Our regression analysis showed that for every 100 basis point (1.00%) increase in the 10-year treasury yield, the mean increase in the 10-year municipal yield was 0.82%.

Furthermore, municipal yields are less correlated relative to corporates which have displayed a 0.97% correlation over this 10-year period vis-à-vis treasuries. For every 100 basis point increase in the 10-year treasury yield, the 10-year corporate increased 0.94%.

One-year data for the analysis above is not included due to the unusual market dynamics of 2020 when correlations broke down. Municipals displayed a 35% correlation with treasuries last year due to the sharp but brief sell-off experienced in March. The correlation with treasuries soon returned in April and thereafter, as investor worries over credit calmed, and liquidity resumed for money market and mutual fund products. This proved to be, and we acted on, a great buying opportunity for SMA strategies.

Certainly, as the “risk-free-rate” (treasury yields) goes, as will municipals over the long term. But according to the data above the volatility is lower for municipals relative to both treasuries and corporates. Hence, municipals should play a role in investor’s high grade fixed income allocation as both a credit and durational hedge. Given the stable to improving credit backdrop for the market and the potential for higher individual and corporate tax rates, we believe municipal valuations are well supported. Furthermore, should supply remain muted, this provides an additional positive input for the market’s technical environment.

How to defend a bond portfolio in a rising rate environment

Given the above, we believe municipals should play a primary role for high income and high-net-worth investors in the current environment. Within the municipal sector, we believe there are three ways to mitigate a bond portfolio’s sensitivity to rising interest rates:

- Target higher – but not too high – coupon bonds: in the current environment we are targeting 3-4% coupon bonds. 5% couponed, “kicker bonds” are attractive as well, though the callability on these is high, so the yield-to-call must offer quite a spread. 3-4% coupon bonds will trade with lower volatility in a rising rate environment relative to a ~2% coupon bond.

- Ladder Structure – the ladder does two important things in relation to duration. It i) diversifies portfolios across the yield curve and ii) enables ongoing cash flow for reinvestment. Both qualities prevent over or underinvesting in particular areas of the ever-changing yield curve.

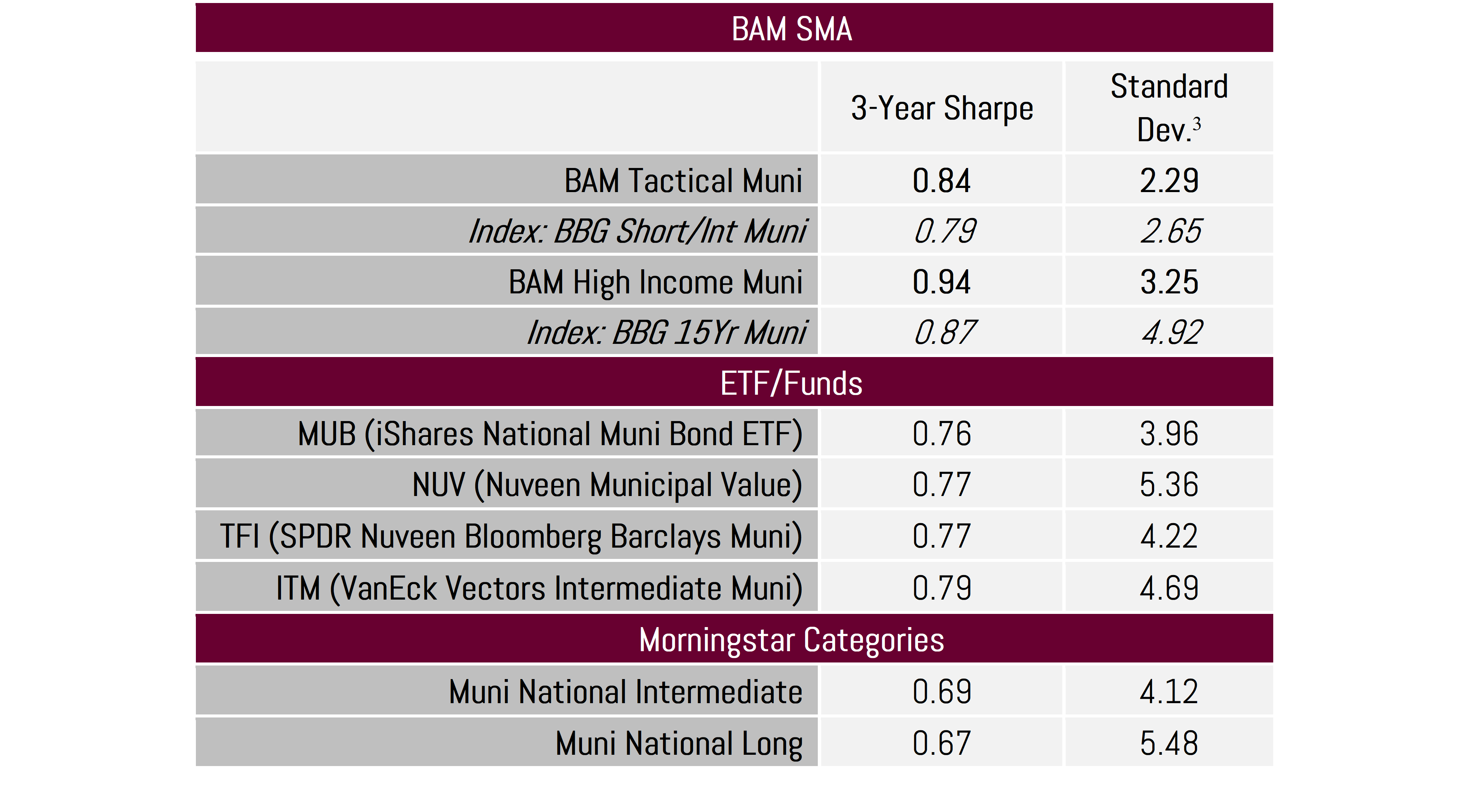

- Target non-benchmark issues – Bernardi Asset Management composite portfolios are centered on non-benchmark, smaller to medium-sized issuers. During volatile markets, like we experienced in March, retail fund flows tend to exacerbate performance of the large ETFs and mutual funds, which passively track the benchmark. These funds are forced to sell these benchmark names en masse, further exacerbating their performance and volatility. We believe that a Sharpe Ratio2 analysis demonstrates not only the greater return potential of allocating away from the benchmark, but also a lower portfolio volatility as well:

Source: Morningstar

Source: Morningstar

The results above show that our Tactical Ladder and High Income strategy composites outperform the comparable benchmark from a risk adjusted perspective as defined by the Sharpe Ratio. Additionally, they should be considered in the overall asset allocation conversation as way to differentiate from passive strategies, reduce portfolio volatility, and add value over the long term for investor’s “mattress money” portfolio allocation.

Please contact your Investment Specialist for information about our Municipal Bond SMA strategies.

[1] Duration can be used interchangeably as both the weighted average time until repayment and as the percentage change in price of a bond based on the change in interest rates. The measurements are often nearly the same, but different conceptually. Both provide an indication of how sensitive a portfolio is to a change in market interest rates. The higher the duration, the higher sensitivity a portfolio will have to interest rate changes.

[2] Sharpe Ratio calculation: Return of portfolio minus Risk-free rate divided by the standard deviation of the portfolio.

[3] Standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean of the set, while a high standard deviation indicates that the values are spread out over a wider range.