RE: “How Muni Bonds ‘Yield’ 4% in a 2% World”

Let’s slow down a bit before jumping to conclusions.

Here are several observations about the October 30th, Wall Street Journal article How Muni Bonds ‘Yield’ 4% in a 2% World.

Author Jason Zweig makes a valid point in asserting that yields cited in a typical custodian brokerage account statements may be misleading.

In our view, the typical custodian statement’s reporting of “current yield” – coupon divided by current market value – is inadequate and needs amplification. We have long held this view and, for that reason, over fifteen years ago began providing our portfolio managed clients with a proprietary quarterly portfolio report to complement their custodian’s statement. In concert, the custodial statement and Bernardi’s proprietary quarterly report provide an accurate, transparent, and thorough description of portfolio metrics. These include various yields an investor can reasonably expect to earn.

The author’s powerful assertions aside, keep in mind he is writing about CUSTODIAL statements. The article fails to discuss industry-wide regulations as to how bond offerings must be presented to investors upfront. Regulatory disclosure requirements, coupled with our own self-imposed internal procedures, offer robust protections to investors.

There are many required disclosures (MSRB Rule G-15). The rule exists to protect investors and requires financial industry participants to clearly disclose a bond’s yield to maturity and its yield to call/worst, if applicable. These yield calculations account for the inevitable premium amortization as a bond approaches maturity. Additionally, the executing broker-dealer is required to send the client a confirmation that details the yield to worst and the yield to maturity for premium bond trades. Regulations also require broker-dealers obtain fair and reasonable prices for the client given current market conditions (MSRB Rule G-30).

Therefore, an alert investor is well aware of a bond’s expected yield at the time he or she makes any financial commitment in a bond investment. The author’s not so subtle implication that broker-dealers and advisors are fooling investors by selling them illusory yields is disconnected from industry rule requirements.

At Bernardi, we strive to provide complete transparency throughout our investment process. Below are two examples that help demonstrate our transparent and complete investment process and reporting. We use these documents in concert with one another in order provide investor clients with a thorough and robust description of portfolio metrics so they are comfortable with our process and how we report to them.

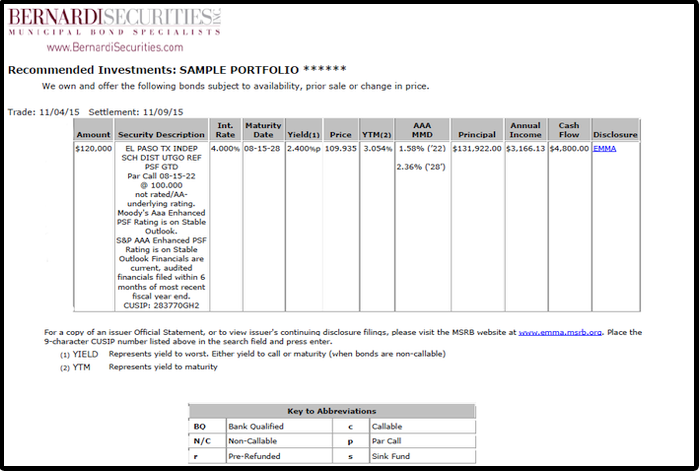

The graphic above is our portfolio management recommendation document. As you can see, the issue presented trades at a premium price. Yield to worst and yield to maturity metrics are featured as they represent the relevant yields. There is no mention of current yield in our presentation for reasons cited by Mr. Zweig. The “ANNUAL INCOME” figure cited for the premium issue represents actual income earned in the first year; the portion of cash flow representing amortized premium has been removed from the reported sum. This income figure is calculated by multiplying the yield to call/worst (2.40%) by the principal dollar investment ($131,922.00). Therefore, the client has all pertinent yield information to consider BEFORE he or she approves the recommendation. A trade confirmation is provided separately.

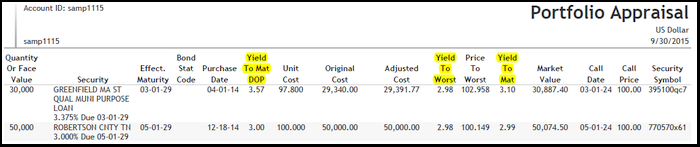

This last graphic detailed is a page from a Bernardi proprietary quarterly report. This report complements the custodial statement. Please note the sixth, tenth, and twelfth columns (highlighted). These show yield to maturity at cost, yield to call/worst at market, and yield to maturity at market.

Investing in bonds and reporting on bond holdings is not a simple endeavor. We purposefully provide a lot of detail offering our clients clear and robust reports.

The WSJ article is insightful, but, incomplete and misleading in certain respects.

We would love to discuss this topic with anyone interested. Thank you for your continued confidence.

Sincerely,

Ronald P. Bernardi

President/CEO