A Century of Tax-Exempt Municipal Bonds: The Good, the Bad and the Ugly

“There are two kinds of people in the world, my friend: Those with a rope around the neck, and the people who have the job of doing the cutting.”

– Tuco “the Ugly” (Eli Wallach), The Good, the Bad and the Ugly, 1966

As the repeal of federal income tax-exemption of municipal bond interest continues to be a threat, let’s review talking points to share with lawmakers. These are based on thorough research and a thirty-two year career perspective of municipal bonds.

We wrap our topic around the iconic, 1966 spaghetti western film, The Good, the Bad and the Ugly, a morality play pitting good versus evil with the juxtaposition serving as a cinematic allegory for our message. The present day municipal bond market represents “the Good” — the many WASHINGTON detractors of tax-exemption do not.

A clear and present danger

As we approach year-end, the threat to municipal bond tax exemption remains a clear and present danger. As long as congressional budget disagreement persists, as long as the Congressional Budget Office, Joint Committee on Taxation, and Treasury officials claim changing tax exemption will generate significant revenue — the threat remains. And it is not removed if Congress agrees to a narrow agreement on this year’s federal budget.

It is incumbent upon state and local government officials, taxpayers and citizens benefitting from public purpose infrastructure facilities to speak loudly and clearly demanding that federal income tax-exemption be left alone.

If these collective voices go unheeded, rest assured, the financial necks of towns, cities, villages, counties, school, water, sewer and park districts across the country will be snug in a noose and, as Tuco bluntly states, other people — tax-exemption opponents — will be “doing the cutting.”

The good — since 1913

Let’s turn to our theme citing some of the positive attributes of the tax-exempt bond market:

- Tax-exempt bonds provide state and local governments with low cost financing. Today, “AAA” rated credits with a 10-year maturity borrow at approximately 2.65%, “A” rated issues of same maturity at 3.44% and bank qualified issuers can borrow at even lower interest rates.

- Tax-exempt bonds provide a stable, reliable platform to finance public purpose projects.

- In 2012, more than 6600 tax-exempt issues financed over $179 billion worth of infrastructure projects, according to the National League of Cities.

- Tax-exempt municipal bonds create jobs for local citizens.

- Bonds build America — from roads, schools and water/sewer plants to town halls and county courts.

- Most citizens benefit from public purpose facilities financed by tax-exempt municipal bonds — many are taxpayers, some are not.

- Tax-exemption encourages investment in public purpose infrastructure projects. It incents wealthy investors to invest funds in our communities.

- Tax-exemption ensures local input and control over community projects. It helps ensure financial autonomy from Washington and its origin is rooted in the doctrine of reciprocal immunity, a basic tenet of our federalist system of government.

There is much “good” in the tax-exempt bond market. Challenge those who attempt to diminish it in any substantive manner.

The bad — really not so bad

Detractors of the tax-free market cite a number of shortcomings, claiming they represent “the Bad.” Some criticism is valid, although much of it is inflated and inaccurate.

Here are the major criticisms of municipal bond tax exemption and brief explanations debunking the alleged shortcomings:

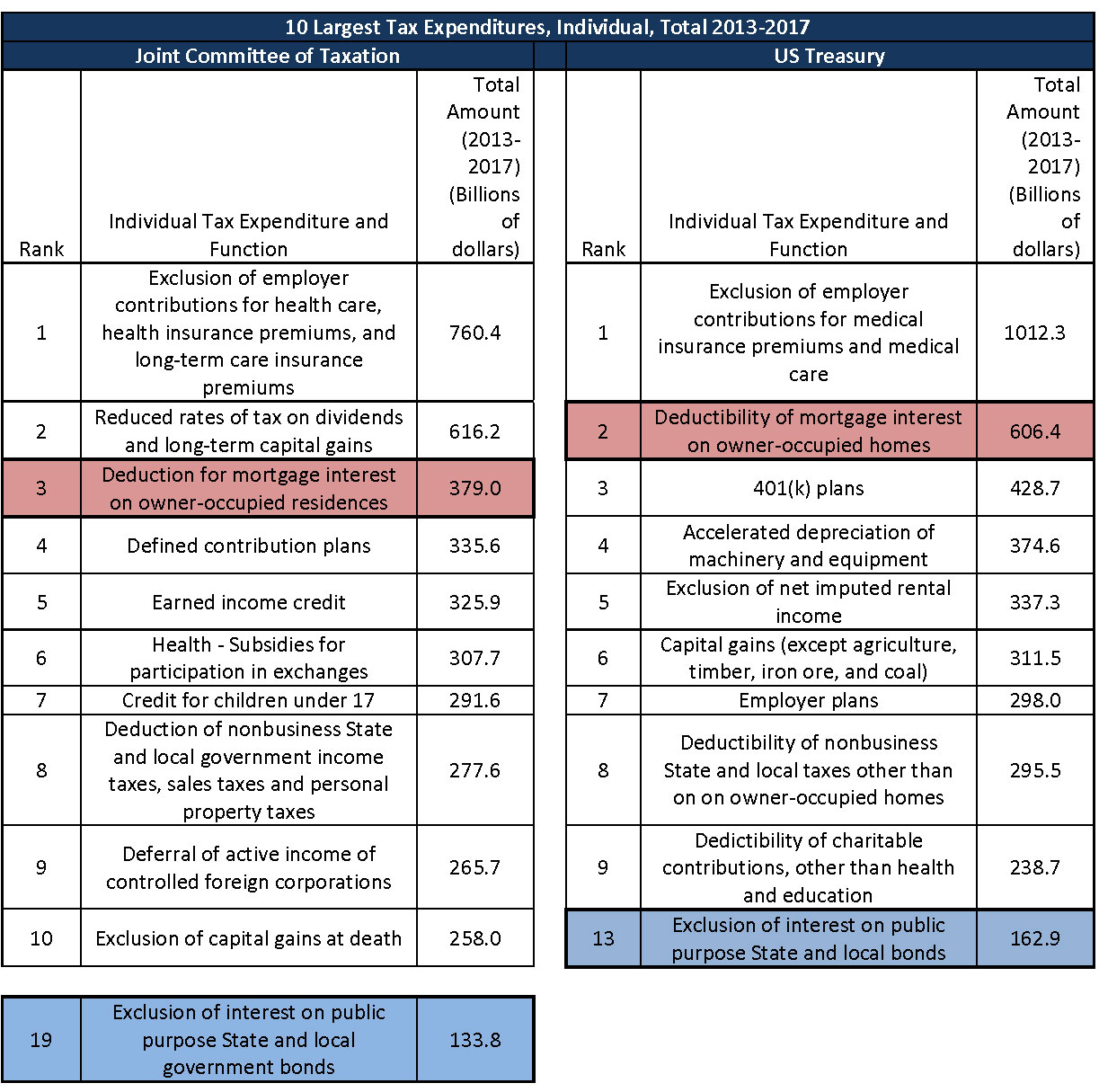

- “Significant cost to U.S. Treasury per Joint Committee of Taxation (JCT) studies.” Without question, the Treasury loses tax revenue because of tax-exemption. This is true about almost all tax expenditures and not unique to tax exemption. But blindly accepting JCT or Treasury calculations as the starting point of any discussion without questioning their accuracy distorts the issue. As the nearby chart shows, federal government calculations places tax exemption far down the list.

Source: Office of Tax Analysis in the Department of the Treasury and The Joint Committee on Taxation.

- More importantly, the methodology used to calculate cost or Treasury’s foregone revenue is deeply flawed. It is fundamentally inaccurate because it relies on simplistic assumptions. One example: certain government methodology assumes investors will reinvest 100% of tax-free bond investment dollars into taxable bonds if repeal occurs resulting in significant additional taxes flowing into Treasury. This assumption is way off the mark and greatly overstates the cost of tax exemption. Many, likely most, investors will change their behavior if tax exemption is repealed or substantively reduced. Many will choose not to reinvest 100% of their current tax-free dollars into the taxable bond market if changes occur. Therefore, the figure cited in certain government’s tables is illusory and trumpeting this “cost” number in the halls of congress is terribly misleading. Our December 2011 white paper, Tax Exempt Municipal Bonds: The Case for an Efficient, Low Cost, Job Creating Tax Expenditure discusses this issue in great detail. The report cites several academic studies that challenge federal government calculations. Professors’ Poterba and Verdugo study illustrates the sensitivity of JCT revenue estimates for eliminating the interest tax-exemption to various alternative portfolio adjustments investors will make if tax exemption is changed. The bottom line of the report — the government’s revenue gain is on average almost 65% lower than JCT calculations.

- “The wealthy benefit disproportionally from tax-exemption.” Tax expenditures are adopted to encourage individuals and businesses to participate in activities they would not participate in absent the tax inducement. That is the point of the tax expenditure. Tax exemption incents people to invest in our nation’s public purpose projects. Investors lend at low interest rates because income earned is not subject to federal income taxes. And it is not only the top “one percent” investing in our nation’s infrastructure. In 2010, per IRS data, approximately 3.3 million tax filers earning $100,000 or less invested in tax-free bonds with 50% of this group earning $50,000 or less.

- “The federal subsidy inherent in tax exemption is inefficiently distributed.” Critics cite the existence of a “clearing rate” as evidence of significant market inefficiency. They claim it unfairly allocates a portion of the subsidy to top tax bracket investors rather than going to state and local governments. The clearing rate concept is generally described as the incremental increase in yield the issuer must pay on its bonds in order for the entire issue to be sold or “cleared.” Critics claim since not all investors in this market are at the top income tax bracket, an issuer pays some additional yield premium to make the bonds more attractive in an effort to induce lower bracket investors to buy the last remaining portion of an issue. This results in top tax bracket investors earning incrementally more yield than would have been otherwise demanded. This is viewed as windfall income by opponents of tax exemption. They claim it reduces the federal subsidy going to issuers and instead is a “freebie” to the wealthy.

Clearly, there are inefficiencies in the market. All markets exhibit certain inefficiencies so this is not a phenomenon unique to the tax-exempt market. But the critic’s “inefficiency” charge is overstated on several levels. It ignores obvious differences between municipal bond market dynamics and the comparable corporate market model federal government officials use to conclude top taxpayers are earning windfall income. Once again, some of the underlying assumptions relied on are wrong — making the model comparison invalid. There are significant differences between the municipal and corporate bond markets: call feature optionality, diversity and sheer number of different issuers, average maturity per issue, average trading block size, and real and perceived credit metric differences to name a few. These are all contributing factors determining the final yield level of a tax-exempt issue. The clearing rate of a typical issue results from the municipal bond market’s inherently idiosyncratic nature.

We all recall the short-lived Build America Bond (BAB) program. According to Treasury, a primary, positive feature of the program was its heightened efficiency. Treasury claimed more of the federal subsidy flowed to the issuer rather than wealthy investors in the form of the clearing rate effect than is the case with the tax-exempt market.

A comprehensive report published by the Swiss Finance Institute debunks this claim and shows the BAB program was rife with pricing inefficiencies. A clearing rate issue clearly existed in this market as well even though few top tax bracket investors bought BAB issues. Why? Because taxable investors recognize the same idiosyncratic features unique to the municipal bond market and demand higher yields to induce them to invest. The clearing rate issue present in today’s tax-exempt market does not represent a significant windfall yield freebie to top tax payers as government officials claim. It results from investors demanding higher yields to offset idiosyncrasies of the municipal bond market place.

The good attributes of the tax-exempt market far outweigh the so-called bad ones. Challenge those who attempt to diminish it in any substantive manner.

The ugly — really ugly

If tax exemption is repealed or substantively altered, market participants will adapt and adjust. Local governments will continue to need capital for projects. Bernardi Securities, Inc. will continue to assist state, local governments and investors as we have done for decades. We are experts in the field and the need for municipal bond market expertise will not disappear.

State and local governments — and most of their citizens — however, will face many difficult choices if tax exemption is repealed or substantively reduced. Here’s why:

- Increased financing costs for local infrastructure projects. On February 6, 2013, Ann Arbor, MI came to market with a taxable and tax-exempt issue both rated AA+. The 2023 maturities yielded 2.50% and 2.0% respectively. In other words, Ann Arbor’s taxable borrowing rate for the 10-year taxable loan is 25% higher than its tax-exempt borrowing costs for the same time period. That is a significant incremental cost that will affect almost everyone living in Ann Arbor. The cost differentials for other time periods were not as extreme as the 10-year spot, but still notable. Compared to Ann Arbor, we would expect less frequent and lower credit quality issuers to experience larger borrowing cost differentials.

- Higher local taxes and user fees. Capital needs of state and local governments will not disappear if current tax exemption is repealed, partially taxed or replaced with taxable market. Local residents will see tax and fee increases to cover higher financing costs.

- Reduced project scope, outright cancellation in some cases. Reluctance or inability to increase local taxes or fees to cover increased financing costs will lead to scaled back projects or cancellation.

- A less efficient market with loss of local autonomy in decision making and more federal oversight. Some tax-exemption detractors seek to replace the tax-exempt market with tax credits. This is a time-tested idea that is a proven failure. The market is thin and terribly inefficient and has been for the more than 30 years I have been in this business. It would be a colossal mistake to attempt to replace the current market with a tax credit alternative. The BAB program offered a tax credit option choice and there was a near complete lack of interest from both issuers and investors. Approximately $200 billion of BAB issuance occurred with the tax credit component comprising less than one percent. One reason is lack of trust by investors and issuers that the federal government will honor any commitments long term. Why should issuers and investors be assured the federal government will not renege on its tax credit commitment in the years ahead given its failure to honor its BAB subsidy commitment to state and local governments — a program that just ended a few years ago?

- Diminished, if not complete loss, of local decision making power over community infrastructure projects. Tax exemption helps ensure local decision making surrounding infrastructure projects. Tax exemption is not just another special interest tax expenditure like the mortgage interest, earned income tax credit or defined benefit plan deductions. Tax-exemption was codified into law as part of the Revenue Act of 1913. The aforementioned tax expenditures did not receive this distinction, in part, because lawmakers wanted to help ensure the doctrine of reciprocal immunity for state and local governments (“the power to tax involves the power to destroy”) — a basic tenet on which our federalist system of government is founded. Tax exemption helps ensure this doctrine. Repeal it, substantively reduce it and Washington bureaucrats will have an even greater say in decisions surrounding your local school building project, village hall expansion, city water plant upgrade, community recreation facility or county courthouse project. The list is long and will affect nearly everyone.

Tax exemption call to action

“I’ll keep the money and you can have the rope.”

– Blondie “the Good” (Clint Eastwood) to Tuco, The Good, the Bad and the Ugly, 1966

The goal is for state and local governments to “keep the money” — the unencumbered right to issue tax-exempt bonds to build public purpose projects. This is what needs to be done. Speak up and speak out.

Ask lawmakers to enact sensible improvements that will strengthen the current tax-exempt market. Here are a few of our thoughts:

- Insist that Congress positively assert tax exemption for public purpose infrastructure projects is sacrosanct. Remove the threat of repeal or idea of capping its value at an arbitrary 28% level. Absolute clarity on this issue will reduce uncertainty, market volatility and improve market efficiency. Greater certainty lowers borrowing costs for communities. That is good for all.

- Refine the scope of “public purpose infrastructure projects” as the current universe of valid tax-exempt projects is too broad. Doing so will reduce the new issue supply. Market efficiency will improve, borrowing costs for communities across the country will decline and Treasury will receive increased revenue. Each year there are many new non-public purpose projects that receive a tax-exempt subsidy. The number of these types of tax-exempt projects should be reduced requiring them to come to market as taxable loans.

- A modified Build America Bond program for public purpose projects should be reinstated. In spite of the severe damage sequestration has had on the view many have of the program, state and local governments and their citizens may benefit from a modified version. Such a program would provide state and local governments with an alternate financing option when the tax-exempt market becomes too volatile and costly, as was the case in late 2008 and 2009. The program would offer a reduced federal subsidy of 20-25% and serve as a market governor of sorts. Issuers would rely on BAB issuance to raise funds if and when the traditional tax-free market became too costly. Placing a limit on the amount of issuance would help limit program issuance abuse.

- Increase “bank qualified” issue size allowance

- Improve issuer disclosure practices. Our 2011 Tax-Exempt Municipal Bonds white paper suggested that implementing standardized required reporting mechanisms and universal recognition by issuers of the importance of compliance would greatly enhance our marketplace. We discussed municipal disclosure improvements in some detail during our recent Public Finance Roundtable, as well as the public finance panel discussion I moderated at the 2013 Bond Dealers of America National Fixed Income Conference. The latter conversation also covered the threat to municipal bond tax exemption.

Before discarding or severely limiting tax-exemption there needs to be a discussion about what it has accomplished over the last century and how it is interwoven into the political and economic fabric of our society. It is important for all citizens to help shape this debate. It should not be controlled by a handful of federal policy makers and congressional staffers removed from the reality of running local government and removed from living in our communities. The discussion should be led by state and local officials from across the country who understand what it takes to run local government. It should be shaped by citizens who pay taxes, by citizens who use and benefit from public purpose facilities financed by tax-exempt bonds.

For all of its shortcomings, the tax-exempt public finance market is envied around the world. It is efficient and reliable. State and local governments have relied on it for 100 years to raise capital to build our nation’s infrastructure.

If we believe in the principles of federalism embodied in the Constitution, if we believe state and local governments should have wide latitude to independently finance public purpose infrastructure projects their citizens need, want and are willing to pay for — then radical changes to the present day municipal bond market should not occur. Substantively changing the market will affect all of us in a significant way.

Ronald P. Bernardi

President and CEO

Bernardi Securities, Inc.

December 4, 2013