A FOUNDATIONAL PILLAR: INVESTOR FAITH AND TRUST

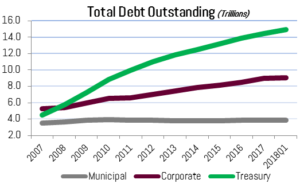

The municipal bond market provides our economy with a deep pool of investment capital. Simply stated, Municipal Bonds Build America.

Investor participation is high as both individual and institutional investors commit their savings to build our nation’s infrastructure: schools, town halls, county courthouses, airports, water and sewer treatment plants, recreation facilities, hospitals, and electric utilities to name a few projects.

It is most often a long-term commitment, an important factor contributing to the deep, dynamic, and liquid municipal bond market.

Importantly, investor faith and trust in the market is a foundational pillar on which the health and dynamism of the market relies. It’s incumbent on industry professionals to strengthen and safeguard this pillar.

What is Regulation Best Interest?

Currently, a major initiative of the Securities and Exchange Commission (SEC) is “Regulation Best Interest” or “Reg BI”. The final version of the rule is expected in the latter half of 2019. The proposed regulation focuses on the conduct standards of industry professionals in their interactions with investors. We have written about this issue over the years in our “Market Insights” (September 2015 and May 2016).

We support the Commission’s initiative on this important issue. It strengthens conduct standards for broker-dealers and investment advisers, while simultaneously preserving investor choice and access to a variety of advice and service models.

It is a complicated subject and it will be difficult for the Commission to craft a solution to placate the differing viewpoints. King Solomon would have a difficult time figuring this one out. But the current proposal is a significant improvement to the status quo. “Progress not perfection” is an appropriate approach and amending the rule in the future is always possible.

In this writing we discuss key issues surrounding the SEC’s proposal. Importantly, the proposed rule allows for investor choice and avoids forcing a “one size fits all” solution on investors, advisers and broker-dealers. We also describe what Bernardi Securities is already doing to address this important issue.

Recently the RAND Corporation conducted a survey on behalf of the SEC. It queried more than 1,800 individuals. Not surprisingly, the results show investors seek information about the investment fees they are charged and the types of conflicts of interest their advisers and brokers may have in their dealings with them. The survey included a “Customer Relationship Summary” (CRS). Under the proposed rule, registered investment advisers and broker-dealers serving retail customers would be required to deliver the CRS to investors.

The RAND survey, along with others, have found many investors are confused whether they are dealing with a broker-dealer or an investment adviser. Investors should understand these differences since there are important distinctions how the two groups interact with them and each have different mandated requirements and market access. For example, the study showed many respondents did not understand the meaning of the term “fiduciary.”

It’s incumbent on industry professionals and their firms to clearly define roles and avoid confusing the issue with a plethora of titles and unclear marketing.

What’s the Difference Between a Broker-Dealer and a Registered Investment Adviser?

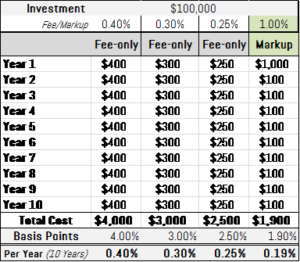

As noted above, cost is one of the most important factors for individual investors when deciding on a manager. Investor misunderstanding regarding how a professional is compensated likely increases the possibility expectations will not be met and it may end up costing them more too.

Typically, registered investment advisers charge clients an ongoing fee (fee-based) calculated as a percentage of assets under management. Normally, their clients also pay additional brokerage fees and mark-ups for trades the adviser executes in their accounts. The adviser monitors the account and, in most cases, understands the broader financial goals and helps plan accordingly.

Broker-dealers charge clients for each transaction they recommend and execute (activity-based). Investor cost is fundamentally transactional based, a “pay-as-you-go approach”. The broker may or may not monitor the account over time: this depends on the extensiveness of the platform of services offered.

Under current law a different legal standard applies to how an adviser and a broker-dealer interact with clients.

A registered investment advisory firm and its registered personnel are subject to SEC regulations and are subject to a fiduciary duty. This is the highest standard and generally means any advice offered must be in the client’s best interest and is subject to a duty of care and loyalty. The advisor must fully disclose any material conflicts of interest and must obtain the client’s informed consent of any conflicts the advisor or company have.

It is important to remember conflicts exist in any successful enterprise. An advisor’s duty of loyalty does not prohibit conflicts but does require disclosure and client consent when material conflicts exist.

A broker-dealer and its personnel are subject to a regulatory regime overseen by several agencies including: the SEC, Financial Industry Regulatory Authority (FINRA) and the Municipal Securities Rulemaking Board (MSRB). Thousands of regulations mandate professional standards for a broker -dealer. As examples, a broker-dealer is required to adhere to FINRA Rule 2111 (Suitability Rule), FINRA Rule 5310 (Best Execution) and FINRA Rule 2121 (Fair Pricing and Commissions) when interacting with clients. A broker-dealer and its personnel are not subject to the fiduciary standard.

Neither the fiduciary or suitability standards prohibit recommending a principal transaction or one that will result in a more lucrative transaction for the firm. Importantly, the governing SEC, FINRA, and MSRB regulations require the standards of “Suitability “and “Best Execution” be satisfied regardless of the investment source and its bottom-line result for the firm.

Broker-dealers and their registered employees are subject to capital requirements, licensing, registration and continuing education requirements. Broker-dealers are required to maintain a certain amount of net capital (Exchange Act 15c3-1) and carry a Fidelity Bond.

Advisory firms do not have either such requirement, although many do carry Errors and Omission insurance policies.

FINRA generally examines its broker-dealer members no less than every 2-3 years. Historically, the SEC examines registered investment advisers less frequently.

As a practical matter, broker-dealers are subject to considerably more regulatory oversight and generally have more available resources if a problem occurs.

What is Bernardi’s Approach?

We recognized the issue of today’s discussion years ago and formed Bernardi Asset Management (BAM). BAM is a SEC Registered Investment Adviser and is a wholly owned subsidiary of parent company Bernardi Securities (BSI). We are a dually-registered firm: we provide investors with options to access our bond market expertise.

We offer these bond portfolio management alternatives:

- Fiduciary, fee-only portfolio management under the BAM platform

- Transactional, mark-up/down management under the BSI platform

Our internal policies and procedures for both platforms embody these three principles:

- provide investment advice and recommendations we believe are in the best interests of investors

- charge fair and reasonable compensation

- avoid making misleading statements pertaining to fees, compensation, recommendations or existing material conflicts of interest

These principles along with our internal procedures guide and direct our management team. Under both options our clients have access to a multi-step, fair and transparent portfolio management platform.

Over the years we have learned several things from our clients:

- Investors want management choices based on their needs and market knowledge

- Most appreciate having a choice as to how they engage us

- Investors appreciate our transparency, our clarity, and understand the differences between the two platforms

At Bernardi we operate and design our policies and procedures with an overarching goal to align our interests as best we can with our clients.

We recognize:

- Conflicts are endemic to any successful enterprise: both advisers and broker-dealers confront them

- There is nothing inherently wrong with conflicts

- The result is often a good outcome

Specifically, there is nothing inherently wrong with a broker-dealer or adviser acting in a “principal” capacity. Years ago, the SEC wrote interpretive guidance on this topic (SEC “Interpretation of Section 206(3) of the Investment Advisers Act of 1940”, SEC release No. IA – 1732).

Similarly, there is nothing inherently wrong with a fiduciary, fee-only adviser sourcing all of its clients’ bond purchases from its custodian – provided the adviser adheres to its fiduciary and best execution responsibilities.

Trust and transparency are the foremost principles of a healthy client relationship: it is as simple as that. This is fundamental to the way we operate our firm.

Investors should ask many questions of their financial professionals and not simply rely on a “fiduciary” or “best interest” moniker.

Regardless of the final form of Regulation Best Interest we will continue to serve our clients faithfully. We have adjusted our business model many times over the years to better serve our clients. An innovative spirit abounds at Bernardi so we will continue to do our part to improve how we conduct our business interactions.

We appreciate any constructive feedback and commentary. Thank you for your continued confidence in our team.

Sincerely,

Ronald P. Bernardi

President & CEO

April 11, 2019